GU Fossil Free (GUFF) is calling on the university to fully divest its endowment fund from all fossil fuel companies by 2024. The group made this demand in a Jan. 17 proposal sent to the university’s Committee on Investments and Social Responsibility (CISR) and has been maintaining pressure on Georgetown with a flyering campaign since then.

GUFF is a student-led campaign with the goal to promote a more sustainable future by ending all the university’s investments in fossil fuel companies. “It is unconscionable to pay for our education with investments that will condemn the planet to climate disaster,” read a statement on its website. “On a practical financial level, investments in these companies are becoming increasingly risky and volatile.”

Celia Buckman (SFS ’21), a GUFF member, explained that the organization is pushing the university to use its endowment responsibly and for students to pay closer attention to Georgetown’s investments. “Spreading the word about our proposal is thus more than just to galvanize student support,” she wrote in an email to the Voice. “It’s about making them aware of proposed changes to their, and Georgetown’s, financial future.”

In 2014, GUFF petitioned the university to divest from the coal industry. Georgetown agreed to stop investing its endowment in coal in September 2015. In addition to coal, the school ended its investments in tar sands in 2018. However, the CISR, which is composed of 12 faculty members, administrators, and student representatives, voted against full divestment from fossil fuels in January 2015.

“Georgetown’s Board of Directors has already demonstrated a willingness to act on climate change, including its decisions to avoid investments in coal and tar sands oil, as well as its decision to support the Paris Climate Agreement,” the proposal read.

According to GUFF, the mission of fossil fuel companies contradicts the Socially Responsible Investing (SRI). Georgetown has referred to the SRI policy for guidance in divestment in the past. Established in 2017, the SRI asserts the university’s commitment to “social justice, protection of human life and dignity, stewardship of the planet, and promotion of the common good.”

The university takes its social responsibilities and its endowment seriously, university spokesman Matt Hill wrote in an email to the Voice. The CISR considers and decides if a proposal submitted by students and faculty merits further consideration, and if so, it can make recommendations to the board of directors.

GUFF stated that divesting from fossil fuels is becoming more crucial, especially in the wake of the United States’ withdrawal from the Paris Climate Agreement in 2017. “Climate change is indelibly and, in some cases, irreversibly changing the landscape of our natural world, endangering most species, ecosystems, and environmental processes,” members wrote in the petition.

GUFF contends that divesting from fossil fuel companies will have a positive effect on the growth of Georgetown’s endowment. Citing a 2013 Associated Press and S&P Index study, GUFF wrote that an endowment without fossil fuel investments would be healthier in the long-run than one that was not divested.

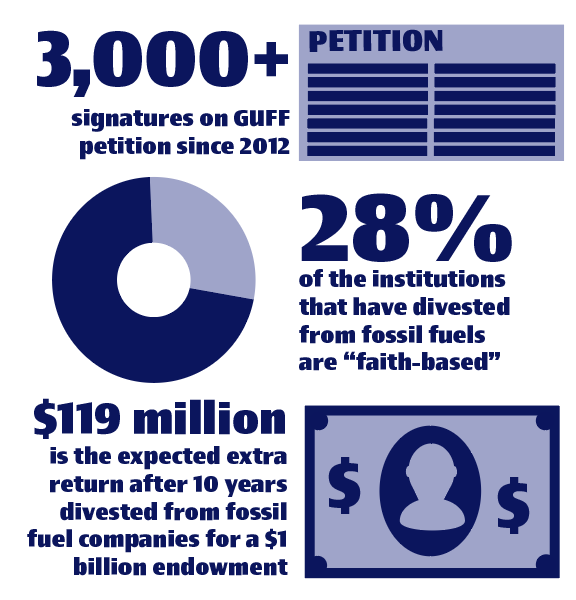

“A university endowment of $1 billion—less than that of Georgetown, but relatively similar in scope—without fossil fuel investments would have performed better than one with fossil fuel investments over a 10-year period by $119 million,” the proposal read.

If Georgetown were to fully divest from fossil fuel companies, it would not be the first university to do so, and GUFF’s proposal includes the financial histories of other universities that have already divested. The proposal shows that in 2015 Syracuse University stopped investing in fossil fuel companies and saw a 12 percent return on investments by 2017. Oregon State University’s endowment has grown by 8 percent since divesting in 2017.

The proposal also lists universities that have taken “positive actions” toward full divestment from fossil fuel companies as well as those who have already committed to full divestment. Notable examples include Stanford University, which divested from coal in 2014; Harvard, which paused investments in minerals, oil, and gas in 2017; and Johns Hopkins, which divested from coal in 2017. Yale divested $10 million from coal and oil in 2016 while revealing to their student body that the endowment now has only “minor exposure” to coal and oil, according to the Yale Daily News.

Over 1,000 institutions—including universities, governments, investment funds, and media groups—have divested from fossil fuel companies, accounting for $7.63 trillion in assets, according to GUFF. Twenty-eight percent of these institutions were classified as “faith-based,” and 122 Catholic institutions had divested from fossil fuels as of January 2019.

Regarding GUFF’s proposal, Hill wrote that the CISR would be inviting the organization, among others, to its next meeting. GUFF has not heard specific feedback from the university and CISR about the proposal yet, according Buckman. However, she wrote that GUFF always welcomes a response and an extended dialogue on the topic of divesting from fossil fuels.

“GUFF also believes in promoting education and transparency around the endowment, as it is ultimately student’s tuition dollars, and the financial foundation of their higher education,” Buckman wrote.

In the past few weeks, GUFF flyers have appeared around different parts of campus, promoting the goals of their proposal. “Our primary objective from flyering is gaining support for our proposal,” Buckman wrote. “That support can come in the form of petition signatures, supporting our proposal as a student group, sharing our content on social media, or a myriad of other ways Georgetown students can make their opinions on the endowment heard.”

The proposal reflects an optimism that the university may have become more receptive to full divestment from fossil fuels since it voted down a complete divestment in 2015. GUFF has gathered over 3,000 signatures since 2012 in favor of divestment, including 176 from faculty members. Since their delivery of the newest proposal in January, more than 400 people have added their names to the divestment petition, including undergraduates, graduate students, faculty, staff, and alumni, according to Buckman. GUFF hopes that this mounting support from the Georgetown community will push the university to accede to their demands.