Ite inflammate omnia. “Go forth and set the world on fire,” a phrase every Georgetown student is told at graduation.

Something must’ve gotten lost in translation between the time that St. Ignatius of Loyola uttered those words and today. Not sure if this was what the Jesuits had in mind back in the sixteenth century, but apparently setting the world on fire looks a lot like working as an investment banker these days. As someone who recently quit her banking job, I think it’s about time that we discuss the elite university to Wall Street pipeline that Georgetown institutionally perpetuates.

For those of you unfamiliar, investment bankers are essentially real estate agents for companies that want to buy or sell businesses. Think of it like being a used business salesman. The job is undeniably appealing, offering fresh college graduates the opportunity to facilitate mergers and acquisitions for some of the world’s biggest corporations. The six-figure salary doesn’t hurt, either.

You could make the argument that advising on multibillion-dollar transactions does, in fact, set the world on fire. However, I was doing no such thing when I fainted at work one Thursday morning earlier this year.

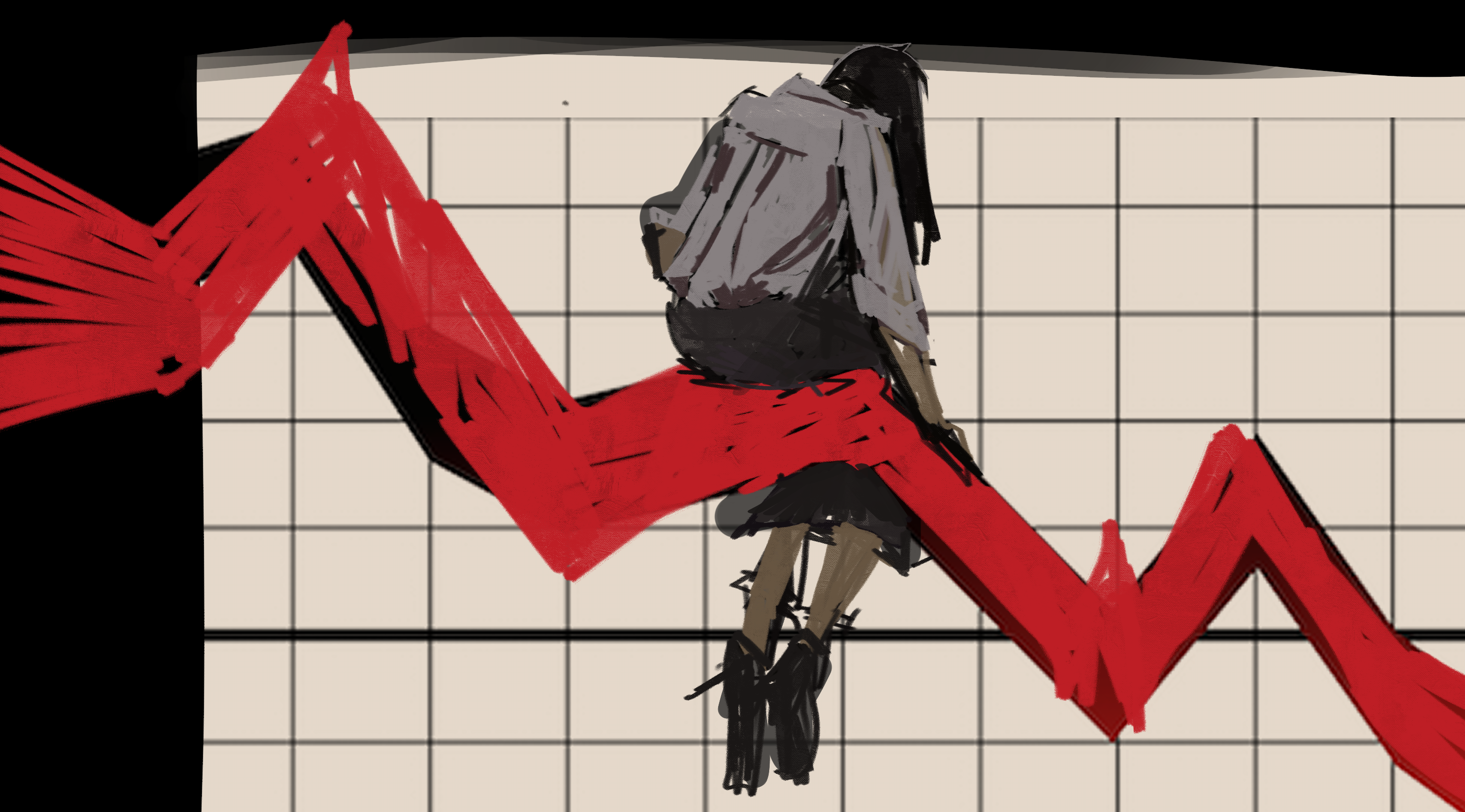

My waking hours were jam-packed with creating endless charts and updating quarterly financial metrics in Excel. The ding of Outlook email notifications from my managing director made me flinch with a Pavlovian response. My work phone vibrated non-stop. Work bled into Friday nights and “protected” Saturdays (Sunday was a work day). With what little sleep I did get, Excel #REF! errors haunted my nightmares. Months of this lifestyle and sleep deprivation had finally caught up to me.

Post collapse, I was whisked away to the emergency room for CT scans and blood and urine tests. “Don’t worry,” my coworkers reassured me. This had happened to three other people on my team. I was going to be just fine.

Well, I certainly didn’t feel fine as I laid on the lumpy hospital bed with a raging headache. I needed to quit this fucking job. The college sophomore Christine who had signed her investment banking offer letter with exuberant gusto could’ve never predicted this outcome.

Investment banking recruiting is deeply embedded in the fabric of Georgetown’s culture. The prestigious McDonough School of Business ranks third on Poet and Quants’ 2024 list of best undergraduate business schools. The spot is certainly well deserved, judging by the outcomes of our alumni. According to the MSB’s 2023 Undergraduate Employment Report, the average full-time salary is $100,859, a 4% year-over-year increase. 56% of graduates ended up in the financial services industry, closely followed by 20% in consulting (big surprise). Top employers include Bank of America, Barclays, Citigroup, Morgan Stanley, and Royal Bank of Canada. At face value, this is excellent news. Those statistics, paired with some tastefully selected snapshots of ethnically diverse students, make for a fantastic informational brochure.

Although the MSB is my wheelhouse of expertise, the banking recruiting frenzy certainly isn’t contained within the business school. Recruiting events are a rare demonstration of pan-Georgetown solidarity across all schools. What smart, high-performing college student doesn’t want to jump-start their career with a lucrative, prestigious job? Especially one that can open doors to even more lucrative, prestigious jobs in private equity?

Georgetown and Wall Street have a beautifully symbiotic relationship: the school takes high-achieving, hard-working students and turns them into a steady stream of talented human capital to feed to investment banks in exchange for institutional clout, which it uses to attract more talented students to feed to investment banks. At the institutional level, Georgetown has a vested interest in funneling students into prestigious finance jobs. Actual individual alumni job satisfaction is a nice perk at best and an afterthought at worst. We have a ranking to defend, after all.

Given this ecosystem, it’s easy for undergraduates to be swept into the investment banking recruiting pipeline. As someone who went through this cycle, I have a few pieces of advice for any undergraduate in the throes of recruiting, or is just feeling a little directionless in general:

Investment banking can be a very beneficial way to start off your career…

At its core, investment banking is undeniably attractive. It provides college graduates with a front-row seat to the corporate strategy of the world’s largest companies. It teaches you everything you could ever want to know about Excel, PowerPoint, and then some. It pays well.

If you want to go to Wall Street, Georgetown will get you there.

…but just because you can, doesn’t mean you should.

This isn’t Wolf of Wall Street. Margot Robbie will not have sex with you. You’ll work until midnight on a good day and you won’t go to bed on a bad one. Sometimes—a lot of times, actually—advising on multibillion-dollar transactions means you’ll be aligning logos alphabetically on slides or poring over hundreds of pages of financial filings until your eyes bleed. And then the next morning your managing director will realize those slides aren’t actually what he wanted, and they’ll be deleted. Overwork to the point of collapse is quite normalized. “We always have one or two a year,” a fellow banker said nonchalantly in response to my hospitalization.

Maybe you’re really passionate about generating shareholder value and nothing else. Or maybe you’re willing to grit your teeth for a few years for that sweet, sweet private equity exit opportunity. Just be confident that you fall into one of the aforementioned categories before deciding to recruit for investment banking.

It is (more than) okay to not know what you want to do as a college sophomore!

Investment banking information sessions proliferate on campus like mushrooms after rain every spring, aiming to reach college sophomores. And the timeline creeps earlier each year, with many firms offering freshman events, creating an environment ripe for FOMO.

For high-achieving students, not knowing what your future holds is terrifying, especially if your peers are locking down junior summer internships. It might seem reasonable to recruit for banking simply because everyone else is doing it. However, it’s entirely okay—normal, even—to not know what you’re going to do after college as a sophomore.

In my opinion, the accelerated recruiting timeline is a feature to poach talent before students’ prefrontal cortexes fully develop and they realize they don’t want to work for 90 hours a week. Take some time to network and explore different careers aside from banking and consulting! They do exist, although you might never know from the career center. And if you’re feeling dejected about not landing a banking offer this cycle, congratulations—you now have the opportunity to find a career that is a better fit for you!

I know all of this is easier said than done, but it’s important to keep this perspective in mind in light of the recruiting frenzy endemic to the Hilltop. Barring massive reform of Georgetown’s career culture (highly improbable), the best thing Georgetown students can do for their professional lives is to cultivate a strong sense of self from within. Take the time to really discover what your strengths, interests, and values are; the best job for you will be at the intersection of these elements. Maybe for some, investment banking fits the bill, but for many others, it can be more fulfilling to pursue something you actually love instead of chasing external benchmarks of prestige. What do you want out of a career? If you can’t answer that question, then Georgetown will, and Georgetown’s answer is to prioritize bolstering the institution rather than students’ well-being.

Best of luck to everyone figuring out their future. There are a lot of ways to set the world on fire—each of them as unique and irreplicable as every individual Hoya.