Interim Provost Soyica Colbert and University Chief Finance Officer Hari Sastry hosted a roundtable on April 29 to discuss Georgetown’s budget. University officials shared their concerns about the impacts of potential federal freezes on Georgetown’s budget and the makeup of the university’s investments, and students had a chance to ask questions.

The same night, students voted to pass a GUSA referendum calling for Georgetown to divest from companies connected to the Israeli military, including Amazon and Alphabet, which owns Google. However, Interim President Robert Groves sent a university-wide email within minutes of the vote results, announcing that Georgetown would not implement the referendum’s demands. Amazon and Alphabet have helped develop cloud services under Project Nimbus for the Israeli government. Georgetown invests $55 million in these two companies.

During the roundtable, which ended less than two hours before the referendum results came out, Interim Chief Investment Officer Chris Gill said that the university’s investment strategies follow a Social Responsibility Investing (SRI) policy which reflects Jesuit values.

“We regularly review the portfolio to ensure compliance with the SRI Policy,” Gill said. “Our holdings in both Amazon and Google are currently consistent in policies.”

When the Voice asked whether student voices impact Georgetown’s investment strategies, Sastry said that the Committee on Investments and Social Responsibility (CISR), which acts as an advisory body for the University Investment Office, includes members of the student body. Of the 12 members in CISR, four are students, including one undergraduate student from the Georgetown University Student Investment Fund and one from GUSA.

Gill also said that Georgetown’s investment involves input from the Board of Directors, the Finance and Administration Committee, the Investment Committee, and CISR.

Gill shared that Georgetown’s plans aim to produce high long-term returns on investment.

“Our goal in the long term, as highlighted earlier, is to generate 8 to 9% returns over the long term, to outperform our policy benchmark, and outperform our peer institutions in the endowment universe,” Gill said. “To help grow the endowment, to have a more connected Georgetown, to have more scholarships, and to improve our standing in the U.S. News university ranking system.”

In response to student questions about the university’s transparency around investments, Gill said that the University Investment Office faces challenges with complete transparency. The budget roundtable presentation wrote that these challenges stem from nondisclosure and other confidentiality agreements, adding that Georgetown’s reputation as an investor is “contingent on trust and preservation of confidentiality,” and that “sharing our playbook and investments across [the] ecosystem reduces ability to outperform peers.”

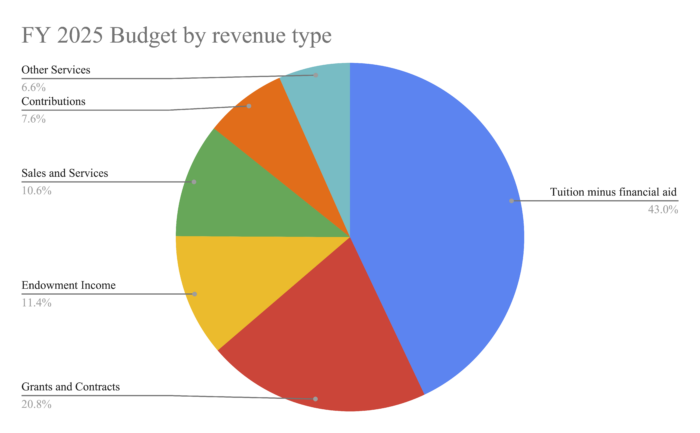

Sastry also shared the breakdown of Georgetown’s revenue for Fiscal Year 2025.

Data taken from roundtable presentation.

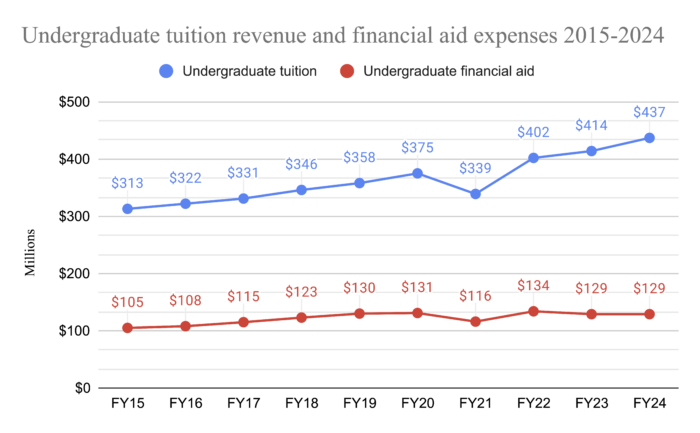

Sastry said that the amount that Georgetown distributes to financial aid is dependent on the makeup of its student body, which varies per year. In the 2023–2024 academic year, approximately 50% of students received financial aid, which includes federal aid, and 35% received institutional aid that comes from Georgetown.

Data taken from roundtable presentation.

Additionally, Sastry said that yearly federal funding for grants and contracts makes up around $200 million or 10% of Georgetown’s annual $1.9 billion in revenue. The federal government also funds $257 million in financial aid for Georgetown students each year, according to Sastry.

The university has implemented “scenario planning,” Sastry said, over the last three months amidst uncertainties over the impacts of unpredictable Trump administration federal funding cuts.

“The challenge right now is that there isn’t a lot of certainty around what’s going to happen. There’s things tied up in courts,” Sastry said. “If you think about the $457-ish million from the federal government to support students and research here, if any of that starts getting hit, that’s going to be an impact to the university.”

Editor’s note: This article has been updated to correct a misheard quote.